四、开证行向议付行偿付

(一)决定不同偿付程序的因素

1. L/C的偿付条款;

2. 开证行与议付行的账户设立情况。

(二)五种偿付程序

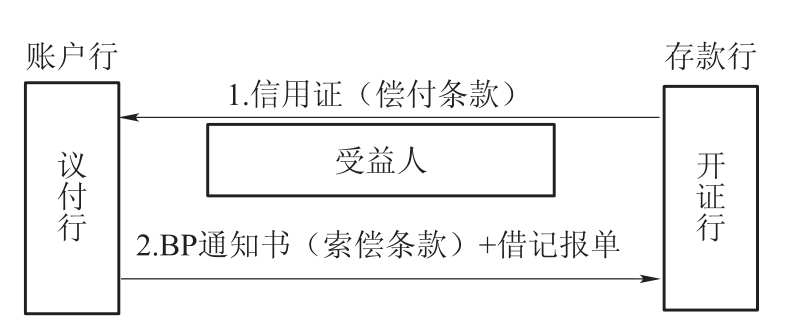

1. 议付行是开证行的账户行(议付行主动借记)

L/C的偿付条款:

In reimbursement of your negotiation under this credit, we hereby authorize you to debit our account with you under your advice to us.

在本信用证项下对贵行议付的偿付中,我行谨此授权贵行借记我行在贵行账户并提供报单给我行。

BP通知书的索偿条款是:

We have debited your account with us.

偿付程序如图5.23所示。

在图5.23中,议付行并不是直接从开证行得到信用证,而是从受益人“买入”信用证,下同。

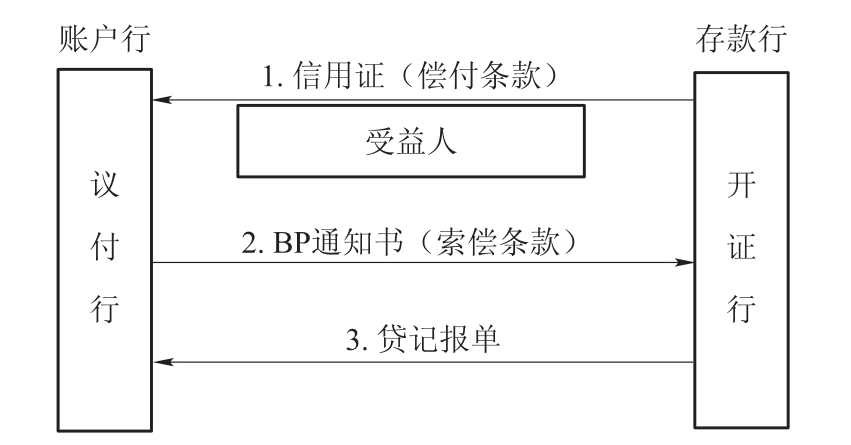

2. 议付行是开证行的账户行(议付行被动借记)

L/C的偿付条款:

Upon receipt of your negotiation advice stating that documents have been complied with, we shall authorize you to debit our account with you under your advice to us.

收到贵行的议付通知,表明单证相符,我行将授权贵行借记我行在贵行的账户并提供报单给我行。

BP通知书的索偿条款是:

Please authorize us by cable/airmail to debit your account with us.

偿付程序如图5.24所示。

图5.23 议付行主动借记的偿付程序

图5.24 议付行被动借记的偿付程序

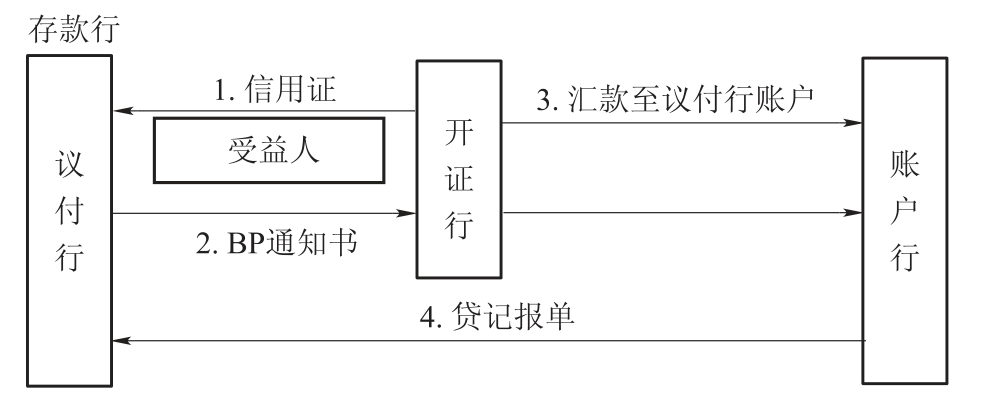

3. 开证行是议付行的账户行

L/C的偿付条款:

In reimbursement of your payment made under this LC, we shall credit your account with us under our telex advice to you.

在偿付贵行在本信用证项下的付款时,我行将贷记贵行在我行的账户并将报单电传贵行。

BP通知书的索偿条款是:

Please credit our account with you.

偿付程序如图5.25所示。

图5.25 开证行是议付行的账户行的偿付程序

4. 开证行与议付行无账户关系

信用证的偿付条款是:

Upon receipt of your negotiation advice stating that documents have been complied with, we shall remit cover by cable/airmail to your correspondent as designated by you for credit of your account with them.

收到贵行的议付通知,表明单证相符,我行用电报/航邮将款项汇至贵行指定的账户行,贷记贵行在该行的账户。

BP通知书的索偿条款是:

Please pay/remit proceeds by TT/MT to C for credit of our account with them.

偿付程序如图5.26所示。

图5.26 开证行与议付行无账户关系的偿付程序

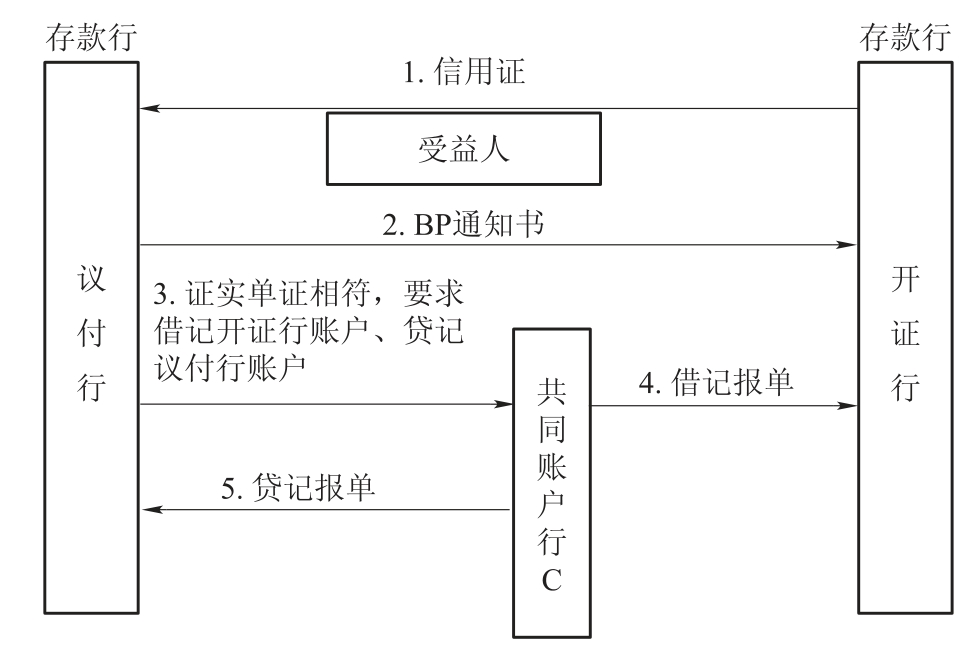

5. 开证行与议付行有共同账户行

信用证的偿付条款是:

Upon negotiation made by you please reimburse yourselves through C by telex/airmail certifying documents complied with and requesting them to debit our account and credit your account with the same amount.

贵行议付后,请通过银行C进行偿付,用电传/航邮证实单证相符,要求银行C将相同金额借记我行账户、贷记贵行账户。

BP通知书的索偿条款是:

We have requested C by telex/airmail to debit your account and credit our account with the same amount.

偿付程序如图5.27所示。

图5.27 开证行与议付行有共同账户行的偿付程序

Q&A 5.8 结算方式的演变(2/2)——从信用证到银行保函和备用信用证

Q:汇款、托收和信用证这三种结算方式有无共性?

A:有,这三种结算方式都针对必然事件,也就是说,在正常情况下,卖方交货的行为是必然发生的,因而,货款收付也是必然要发生的。

结算方式的第四个演变路径是,形成针对或然性事件的结算方式,也就是说,在正常情况下,款项收付很有可能不会发生。例如,对于买方支付给卖方的定金,需要有银行为卖方做出担保,万一卖方在收到定金后不履行交货义务,银行保证向买方退还定金及相应损失,这种银行担保就是银行保函和备用信用证。

免责声明:以上内容源自网络,版权归原作者所有,如有侵犯您的原创版权请告知,我们将尽快删除相关内容。